Trying to stay ahead in this difficult economy is almost impossible for the independent hearing aid dispenser. There’s competition, business expenses, and a market more interested in saving money than spending money even in matters of health.

That means each individual hearing aid practitioner must find ways to cut business expenses without cutting the quality of services provided. Not any easy thing to do an A contracting economy. And when customers discover that a quality hearing aid costs at least $1000 per ear, expect sticker shock to set in.

That means you must go over the operating budget to determine where you can cut corners without cutting services and jobs. Cutting services diminishes your business is reputation in the community, and laying off staff is like saying goodbye to family.

Where to start?

Maintenance

It’s important to keep your store clean and looking professional, even if you were on the vacuum Sunday afternoon. This is not an option. A dusty, messy store does not build confidence.

If you employ an office cleaning service that promised during all business hours, talk with the owner to see if you can either negotiate a better price, or use the cleaning service less often, instead of nightly have the crew, in two nights a week.

Inventory – Order As Needed

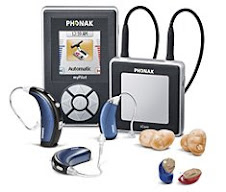

It’s nice keeping a large inventories because your customers can walk out of the store wearing their new hearing devices. However, keeping inventories may be expensive. Especially if a wholesaler expects payment upon delivery.

In this economy, it may not be possible to keep the inventories that you once did. However that shouldn’t stop you from trying. Contact your wholesalers representative to determine if they can extend your normal payment terms.

Wholesalers and manufacturers are also feeling pinched in this tight economy. They want to work with you. So, you may be able to maintain adequate inventories to meet customer demand without paying to carry the inventories.

In this day and age quotation mark Warner as needed is not a problem with it overnight delivery.

I keep samples of all the makes and models by cell face sell OK so that customers can see and sample each model and type of hearing it. I keep a small inventories of my most popular models and have a wholesaler that provides supplies like batteries, carrying cases, cleaning kits and other after-purchase supplies.

This “order as needed” approach will save on the cost of maintaining inventory in the store. However, I opened a FedEx account in my company name and have all orders set to ship with a simple e-mail to the manufacturer. I have the unit the next day, ready for tuning based on the hearing evaluation results.

This enables me to deliver the precise unit in the exact color, usually within 24 hours of order placement and it saves thousands of dollars annually on carrying costs and taxes on inventory. Well worth the additional expense of a reliable delivery service that can get product in the store ASAP, as in the next day.

Tele-commuting is a benefit. Use it.

Some larger retailers and independently owned chains keep administrative staff on location – in a store office, for example. Offer these administrative employees the opportunity to work from home in exchange for a slightly lower wage or a few give-backs in benefits.

The software to conduct business from remote work stations is easy to use and will save employees and you thousands in driving expenses. You’ll be amazed at what administrative employees will give up in exchange for the work-from-home option.

Outsource

Like any small business owner I have quarterly tax filings, annual tax filings, I have to get out W-2s to staff – in other words, I have a lot of accounting and bookkeeping tasks that need to be done.

And it might make sense a few years back to hire a bookkeeper/accountant but today I outsource the work at one-half the cost. I don’t have to pay benefits, I never worry about sick days or employees who leave without giving notice.

All of my taxes are prepare by a professional firm that tracks my numbers in real time. AND they file electronically and handle the reminders and file routine paperwork on my behalf.

Same with my legal counsel. I buy and sell businesses, need to create LLC, need advice on risk exposure and other legal matters. Well, it doesn’t make a lot of sense to keep an attorney on staff so I pay be the hour, work with someone I trust and, though it costs me $40 just to say “Hello” I know I’m getting quality services on an as needed basis.

Winterize and Summe-rize

Clean and maintain your store furnace each year. Same with the air conditioning unit on the roof. Tune it each spring before the hot weather heads your way.

Something as simple as a furnace tune-up can save 20% on your heating bills. You do the math. Oh, and if your furnace is more than 15 years old, consider replacing it. the technology has come a long way and will save you money over time.

Same with the AC unit. If it isn’t efficient, you’re spending more on keeping customers cool than you have too. Again, talk to an HVAC specialist to see just how long it takes for your to break even on a new furnace and/or AC unit. Anything under three years is worth very consideration.

The Lease

Many hearing aid retailers forget that they have a lease – usually a five- or 10-year lease on their store space – that can be renegotiated, especially in difficult times.

Your landlord would rather have your business stay put than to put out a vacancy sign. A vacant store is losing money for the landlord. Consider talking to your landlord, discussing your evolving operations model and see if you can (1) lower the monthly rent and/or (2) pick up a few free services like snow plowing, landscaping, etc.

This is an especially good tactic if you’ve been in your location for a few years and demonstrated that you’re a good tenant. A smart landlord will work with you during difficult economic times to keep your business in place, even if it means losing a little money each month.

A vacancy sign in a small strip mall or professional building does NOT look goo so you do have some leverage here, but don’t abuse it. Work out a deal that both you and landlord see as beneficial. You share common goals and interests and should work as partners, not adversaries.

There are lots of ways to cut a few hundred here and there if you do a line item analysis of expenses. If you have a head for figures, a business tax prep software cane cave you thousands. Of course, you have to do the work your self BUT THOUSANDS!

The Little Things

Even if it’s little things – ask employees to pay for coffee and lock the supply closet to stop the mysterious paper clip caper. Talk to your staff to determine what concessions they could make to help the business and increase job security.

Look for innovation. Often, your staff will have the exact solution you need. After all, they do the work every day. Example? Warm leads delivered to the sales staffs’ inboxes each morning. You pay for the service but, in time, that SaaS will more than pay for itself.

Each is a small step – a cost of $1,200 with a savings of $1,800. Or maybe a 15 % decrease in heating costs. That can keep a staff member within your family – the one you’ve worked so hard to create.

Finally, let attrition follow its course. As employees retire or move on, think of ways to replace that service level without adding the expense of a new salesperson.

Now’s the time to think outside the ear canal and get create in saving on operational costs.

Start with an analysis of your line-by-line budget – outgo. Where does the money go and is that an expense that can be eliminated or at least lowered. (Order as needed!)

Then, talk to your partner – your landlord to see if there’s any wriggle room. Keep it civil but it sure doesn’t hurt to have a lunch to negotiate better terms. Believe me, your landlord WANTS you.

It comes down to this:

Perform a line-by-line analysis of where the money goes

DIY – ask staff to dust and empty wastebaskets before leaving.

Tele-commute – let your employees work in their PJs if they want to. They save drive time, have more flex time to care for kids (no day care expenses) – they save money, even if you ask for some givebacks like higher deductibles on insurance. Most employees will jump at this chance.

Outsource – buy the service as needed and only pay for what you get

Go on an “Order as needed” inventory systems. Keep a small supply of your most popular models but open an account with UPS, FedEx or some other delivery service so you can handle ordering and shipping by computer. And you and the customer have the hearing aids the next day.

Clean the HVAC systems.

Winterize. For example, build a small entryway at your front door to keep out the cold, wintery breezes or the stifling humidity. Something like this will coast a few thousand to build but save on fuel costs for years to come.

No comments:

Post a Comment